Of money and assets: An analysis of NGU’s 990

C.J. Eldridge, News & Features Editor

Have you ever wondered how much NGU is worth or how much it costs to run the school? The information in the Form 990, an IRS document that no-profit schools must file annually, has all the answers.

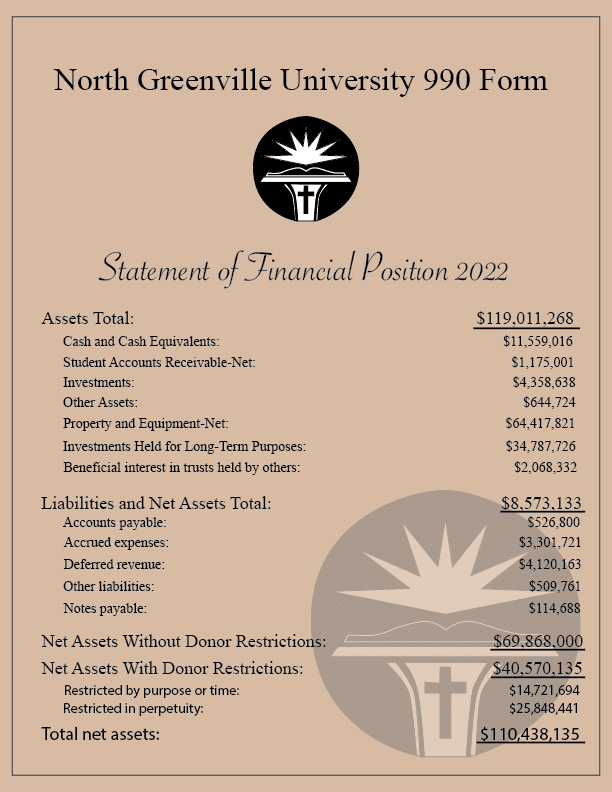

NGU’s assets were valued at $119 million at the end of the year, which is actually lower than they were at the beginning: $123 million. One of the reasons for this is a loss in investments.

Total revenue for this time was $70.9 million, which is around seven million more than the prior year. Total expenses for the same period were $68.7 million.

While a leftover $2 million may seem like a lot of extra cash, it isn’t. Michael Stowell, NGU’s vice president of finance, said the university spends on average $4.5 million every month to keep everything going. That money is gone after a couple weeks.

$20 million was listed as expenses for “Grants and other assistance to domestic individuals.” Stowell explained that the vast majority of this was scholarships provided to students by NGU.

One number that stood out was labeled as “Net unrealized gains (losses) on investments” for negative $4.9 million.

According to Stowell, NGU started the 2021-22 tax year with close to $41 million in investments. The bulk of this is made up of permanent endowments gifted to the school. These are given by donors who want to support North Greenville. The income generated from these is used to award scholarships.

“It’s invested, and investments go up and down,” Stowell said. “That year the markets didn’t do well.”

This money is invested through three different investment managers: the Baptist Foundation of South Carolina, Goldman Sachs and UBS. They were selected through a request for proposal (RFP) in fall of 2020. An RFP is where an organization requests a service and other companies submit proposals to fulfill this request.

These are the independent contractors that the university used for the fiscal year ending in 2022.

Aramark Services, which manages NGU’s food service needs, was compensated $3.6 million. For landscaping and janitorial duties, NGU paid The Budd Group $1.4 million. Slingshot, which provides course materials, was paid $1.2 million.

Stamats Communication was paid $943 thousand for media advertising. This company does work for admissions. One of their projects was redesigning the main university website.

For construction services rendered, AFS LLC, based out of North Carolina, was compensated $586 thousand. They did general renovations and repairs around campus, including work on White Hall, Todd Dining Hall and Hayes Gym.

The 990 also lists the salaries of higher level administration at an organization. The following were the top three earners at NGU: President Gene Fant, Executive Vice President Rich Grimm and Senior VP of Finance Michael Stowell.

Lastly, there were 29 total board trustees listed at NGU. All members are required to be listed on the form. The board’s work is volunteer based. The members are approved by the South Carolina Baptist Convention. This is usually a paid position, but not at NGU.

All of these amounts just go to show that even a smaller university such as North Greenville has a great amount of expenses.

North Greenville University fills out the Internal Revenue Service’s Form 990 every year. If an organization is tax exempt and has $50,000 or more in gross receipts, this is required to maintain this status.

This form is public information and can be accessed by anyone at this link.

The university is labeled as a 501(c)(3) public charity, a nonprofit group with a dedicated mission.

The latest available 990 is for the tax year that ran from June 1, 2021 to May 31, 2022. 2023’s 990 is currently unavailable, as it takes 12 to 18 months after the fiscal year has ended to be publicly accessed.

Infographic by Andrew Davidson.