Finances and the successful student

Keely Lyons, Staff Writer

As students prepare to say goodbye to the days of cooking ramen in a coffee pot and hello to a world of new responsibilities and higher-paying jobs, they must learn to steward their finances accordingly.

North Greenville University offers a personal financial stewardship course in which Rick Martinez, dean for undergraduate programs and professor of management teaches. Martinez said, “It is a course that helps us understand what we mean by financial success and what a biblical understanding of financial success is. The main mindset change has to be that all of us understand everything belongs to God. Finances are simply a tool God allows us to use for His will and His glory.”

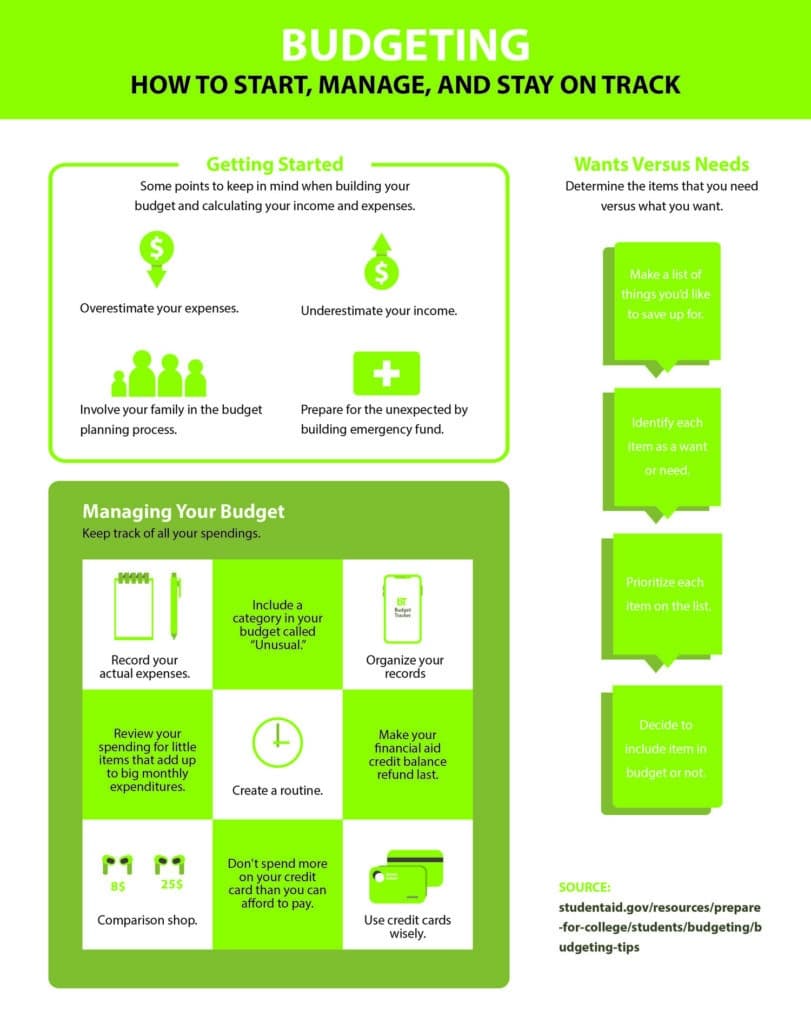

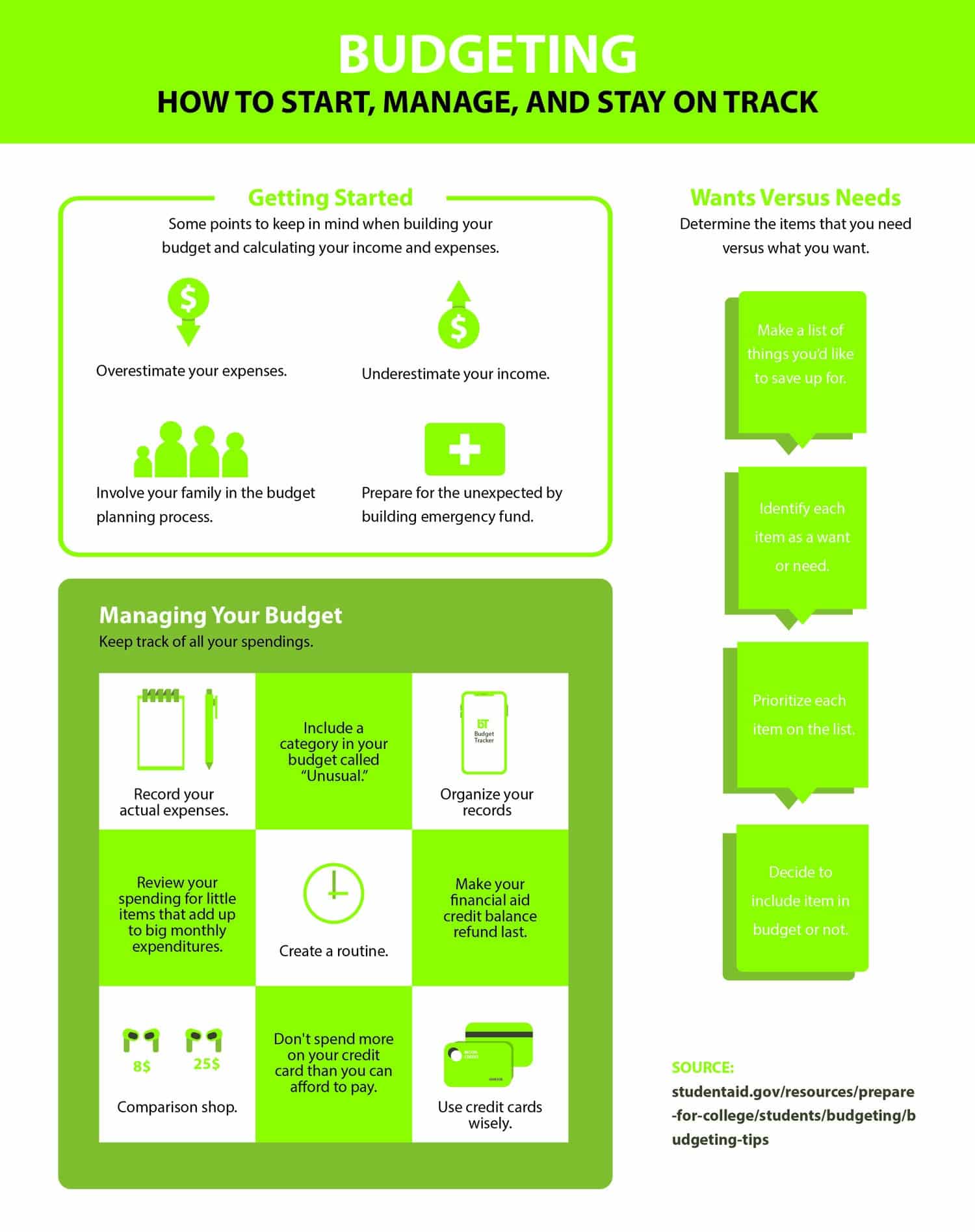

Students have an opportunity to use budgeting as an effective solution and guide in discerning how to be wise with money. As Dave Ramsey, financial advisor and radio personality of The Dave Ramsey Show said, “When you do a budget it is not a straight jacket, it is you telling you what to do. It is a guardrail. It’s ‘don’t run off the road.” Ramsey said, “Everyone has a limit on everything. A budget is just admitting it.”

In a 2015-2016 study conducted by Urban Institute, a website dedicated to economic and social policy research, the average full-time dependent college student earned $3,900 annually, while independent students earned around $13,880 on average. Creating a budget applies to every working person, regardless of the total sum of their salary, whether it’s $40,000 at a post-graduation job or $3,900.

With apps like Mint, a personal budgeting and finance app, creating a budget is accessible and easy to do. Mint can calculate your average spending by category, creating an organizational list to follow. The app links with your bank account and tracks spending, which helps individuals to stay on track of their goals.

Alternatively, students can use Google Spreadsheet or Excel to log a budget. Ramsey says to sit down and write down your income, create an expenses list (how much money you pay out in subscriptions, bills and groceries), and subtract your expenses from your income to equal zero, which means making sure the amount you pay out monthly doesn’t override what you make or are putting aside for savings.

Ramsey said, “Every dollar has an assignment before the month begins.” He said, “You live according to the numbers you write down and you do not spend anything except what is written down without coming back and adjusting the budget.” He encourages people to get ahold of a system, otherwise, finances can become out of control and debt can rule your life.

Faced with the pressures of a consumer world and constantly being encouraged to buy the next big thing, graduating students should take into account the importance of separating a need from a want. Martinez said, “We should minimize our expenses that are irrelevant, unimportant, or don’t glorify God. It is a mindset that says ‘I don’t have to have that thing or brand.”

Martinez refers to this process and change in people as “Metanoia.” He said, “[Metanoia] is a change of mind and heart. It means changing your mind about things. The scriptures use it in the New Testament as ‘penitence.’ College students at the beginning of their career can have that mind shift to use their finances as a resource for glorifying God because He owns it all anyway.”

What we give back to God in tithes is also an important aspect of financial planning. Franklin Aviles-Santa, professor of management and international business at North Greenville University, said, “As Christians, we are called to stewardship. We have 10% we are called to give to the Lord and we are called to use it to restore the earth.”Aviles-Santa said, “Everything we receive is a blessing brought by the Lord. We should be managing it. Since the beginning of Genesis, the Lord is working and creating and he is calling us to do that in the same way.”

As students approach graduation and bid farewell to their university days, many will be contemplating marriage and starting a new chapter in life. Aviles-Santa said, “Students here typically get married quickly but are financially not ready. Love is wonderful, but finances are also important.” Aviles-Santa says many differences in marriage are over finances, which is why it is vitally important to start budgeting early and develop your own healthy habits beforehand.

When beginning to sit down and budget finances, Aviles-Santa said students should prioritize and create a plan for how they use their money. As an important tip, Aviles-Santa said, “Maximize how you use your money and save. When traveling, don’t spend money on expensive hotels. You won’t be there most of the time, anyway.”